The Income Tax Act, 1961 has been amended to insert a new section 194-O. This new provision will come into effect from October 1, 2020. Said provision will be enforcing a tax deduction at source (TDS) with regard to payments made by an e-commerce operator to an e-commerce participant.

Who are e-commerce operator & e-commerce participant ?

An e-commerce operator is the person who owns, operate or manages digital or electronic facility or a platform for electronic commerce. And an e-commerce participant is the person selling goods or services through such digital or electronic facility or platform, provided that such participant is an Indian resident.

For instance in case of platforms like Flipkart or Amazon there are many retailers who sell their product using these platform, as all products on display are not directly sold by Flipkart or Amazon. In such a case where retailers use these platform to sell their products, Flipkart and Amazon acts as e-commerce operator while these retailers are the e-commerce participants.

Who shall be responsible for the TDS?

Where sale of good or services of an e-commerce participant would be facilitated by an e-commerce operator through its digital or electronic facility or platform, such e-commerce operator would be required to deduct tax at source under S.194-O. For the purpose of S.194-O, e-commerce operator shall be deemed to be the person responsible for paying to e-commerce participant. The tax would be deducted by e-commerce operator at the time of credit of amount of sale of good or services to the account of an e-commerce participant or at the time of payment thereof to such e-commerce participant by any mode, whichever is earlier.

How much TDS would be there ?

The rate at which e-commerce operators are required to deduct tax would be 1% of the gross amount of such sale of goods or services. In case a payment is made by a purchaser of goods or services directly to an e-commerce participant for the sale of goods and services, facilitated by an e-commerce operator, such amount would also be deemed to be the amount credited or paid by the e-commerce operator to the e-commerce participants and would be included in the gross amount of such sell or services for the purpose of tax deduction.

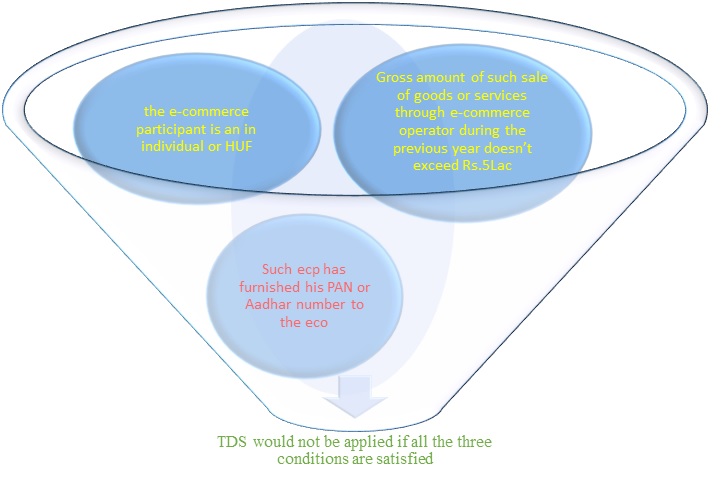

However there is a scenario where such TDS would not be deducted and it can be deduced by following diagram-

A Lower TDS certificate can be obtained by e-commerce participants by submitting Form 13 under parameters of S.197.

Is there possibility of TDS under any other section ?

No. Tax cannot be deducted under any other provision of the Act if it is deductible or, for the proviso to the section, is not deductible under S.194-O. It has to be noted here that this rule would not be applicable if the amount received or to be received by the e-commerce operator for hosting advertisements or providing any other services which are not in connection with the sale of goods or services as per the section